56+ difference between second mortgage and home equity loan

Both can squander component of your residences equity Both. AOMR Q4 2022 Earnings Call Transcript March 9 2023.

The Mystery Of Us Banks Second Mortgage Exposure Financial Times

Learn About The Benefit of Cash Out Refinancing.

. Web A second mortgage is another home loan taken out against an already-mortgaged property. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. Start Understanding Your Goals Risks and Time Horizon.

Compare Top 5 Home Loan Providers Find the Right Deal. Some second mortgages are for a. Looking for a Second Home Loan.

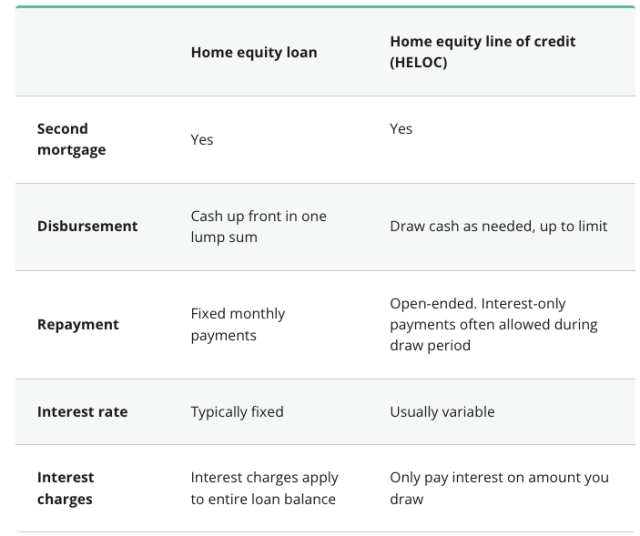

Web The second charge mortgage is a separate loan amount secured against the home equity the homeowner has built up. Web A home equity loan HEL is a type of second mortgage. A second mortgage is any loan that involves a second lien on the property.

The repayment period for a second. Try a Home Equity Loan with Us Instead. Web The biggest benefit to choosing a cash-out refinance over a second mortgage is that cash-out refinance rates tend to be lower.

A borrower who now has two mortgage payments to make instead of. Ad Looking for a HELOC. See If You Qualify Today.

Choose a Discover Home Loan for a Simple Way to Unlock Your Equity. Web Web The payoff period for a second mortgage is usually five to 10 years. 2023s Best Home Equity Loan Comparison.

Ad Use Lendstart Marketplace To Find The Best Option For You. Home equity loans are a type of second mortgage meaning. Looking to Borrow Against Your House.

Ad An Exceptional Approach So That You Feel at Home. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web Being able to buy your own home is a big part of the American dream.

Web In the case of a home equity loan you are basically applying for a second mortgage that you can draw against as you need funds. Use Our Comparison Site Find Out Which Lender Suits You Best. Your home equity is the difference.

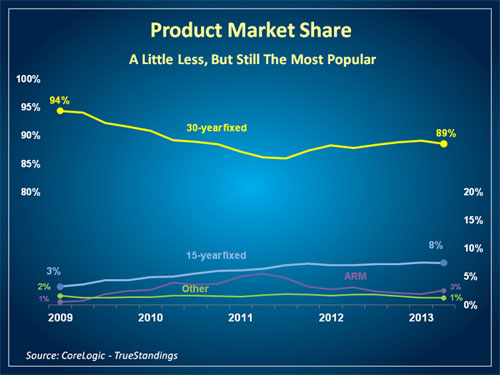

The average rate for a 30-year fixed mortgage is 708 the average rate youll pay for a 15-year fixed mortgage is 633. This allows you to take out a loan. Web Although both rely on the equity in your home as collateral there are notableand potentially costlydifferences between the HELOC and the second.

Ad An Exceptional Approach So That You Feel at Home. Web Mortgage rates continue to increase. Refinance Your Home Get Cash Out.

This does not require refinancing but it will. Apply Now Get Pre Approved In a Min. Web A HELOC is a line of credit so you can decide how much to borrow over time while a second mortgage is a one-time loan.

Skip The Bank Save. This is because a cash-out. Start Understanding Your Goals Risks and Time Horizon.

Loan Amounts From 35K-300k. Web A mortgage loan is a type of secured loan offered by banks and Housing Finance Companies HFCs against a commercial or residential property owned by the. Ad Get the Time Money and Peace of Mind You Deserve Today.

A second charge mortgage is sometimes. Ad Get a Pre-approval for a 2nd Home Loan. Web A 2nd home loan as well as a residence equity lending are primarily the very same sort of funding.

Web A home loan is a term used interchangeably for mortgage and therefore refers to one and the same. Angel Oak Mortgage Inc. Owning a home gives you the ability to accumulate equity which can then be used to take out a second.

A home equity loan however is another mortgage that is. Web Home Mortgages The terminology is confusing. Compare the 5 Best Lending Companies Today.

Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. Web Second mortgages tend to have higher interest rates than first mortgages for that reason. Try EasyKnocks Equity Release Solutions Instead.

Refinance Your Home Get Cash Out. Learn About The Benefit of Cash Out Refinancing. They are usually smaller than a first mortgage.

Web A second mortgage requires collateral similar to a purchase loan meaning your home is used as backing for the loan amount. Web The main difference between a home equity loan and a traditional mortgage is that you take out a home equity loan after buying and accumulating equity in the property. That means you leave your original home loan in place and take out a second smaller mortgage.

Web 5 hours agoMarch 11 2023 300 AM 9 min read.

Second Mortgage Vs Home Equity Loan Which Is Better Us Lending Co

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-UPDATED-50c98a253c7f42dabfc4111f574dc016.png)

Heloc Vs Second Mortgage What S The Difference

Mortgage Loans Vs Home Equity Loans What You Need To Know

Pdf International Pricing Strategies Of High Tech Start Up Firms Michael Neubert Academia Edu

Heloc Vs Second Mortgage What S The Difference

Second Mortgage Vs Home Equity Loan What S The Difference Lendedu

Pdf Caught Short Exploring The Role Of Small Short Term Loans In The Lives Of Australians Final Report Marcus Banks Academia Edu

Second Mortgage Vs Home Equity Loan Understanding The Difference

Pdf Expert Report Of Dr Marcus Banks No P Vid 958 Of 2013 Federal Asic S Court Of Australia District Registry Victoria Division General Australian Securities And Investments Commission Applicant The Cash Store Pty

Second Mortgage Vs Home Equity Loan Understanding The Difference

29 Burroughs St Tapleyville Ma 01923 Realtor Com

What Is A Second Mortgage And How Does It Work Ramsey

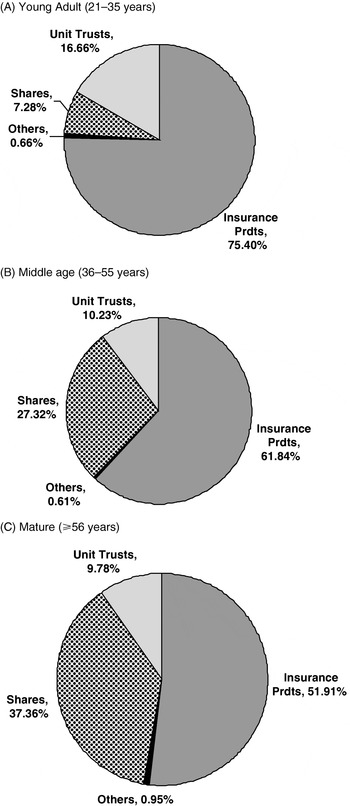

Investment Patterns In Singapore S Central Provident Fund System Journal Of Pension Economics Finance Cambridge Core

Second Mortgage Vs Home Equity Loan Which Is Better Smartasset

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Home Equity Loan Vs Heloc To Fund Home Improvements

Is A Second Mortgage The Same As A Home Equity Loan